Background:

As it turns out a bug introduced to this report, sometime this year can cause figures to be inaccurate because of missing employees. As most of you know Iowa and Illinois have a reciprocal agreement between the two states about SUTA State Unemployment Tax. This agreement is the only one in the entire United States of course. The agreement states that employers will pay state unemployment taxes on employees based on where they work not where they live. So therefore, if you are an employer in Iowa and have employees in Illinois you will pay Iowa unemployment tax for the Illinois employees. The opposite is true for Illinois employers. You will pay Illinois unemployment tax on your Iowa employees.

Issue:

The bad report will not display the employees from the opposing state. If you are employer in Iowa the Illinois employees will not show up and visa versa. The 2012 version fixed the Iowa report. The report for Illinois is still a problem but there is a work around for both older versions of the software and Illinois employers. You need to update the tax table records for the opposing state. For example, if you are an Illinois employer you will be updating the Iowa tax records. If you are an Iowa employer, you will be updating the Illinois tax records. In either case do the following:

1.) Open your Cougar Mountain Professional Payroll.

2.) Go the options menu at the top of the screen.

3.) Select Codes and then Tax Tables.

4.) Find the tax code for the state that applies to you. I will be using Illinois in my example.

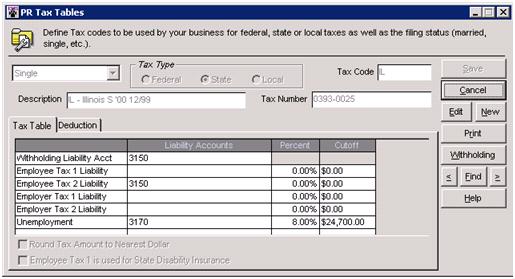

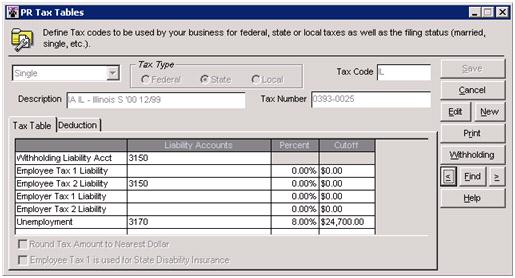

Once you have the tax table record on the screen, which looks like the one below click edit and add the IA to the beginning of the Description field. Once completed it will look like the second screen below.